How to Be Safe In Fake Online Payment & Transaction

Last Updated on: 4th June 2024, 12:45 pm

The rapid advancement of technology and the increasing digitization of financial transactions have made online payments and transactions an integral part of our lives. While this convenience offers numerous benefits, it also exposes individuals and businesses to the risks of fake online payments and transactions.

The purpose of this report is to provide comprehensive guidance on how to stay safe from fake online payments and transactions. In an age where cyber threats continue to evolve, awareness and vigilance are key to protecting oneself from falling victim to scams and fraudulent activities.

This report will cover various aspects of safeguarding against fake online payments and transactions, including recommended actions, precautions, and methods to identify and prevent cyber fraud.

Payment Gateway Awareness

Payment gateways play a crucial role in facilitating online transactions between customers and businesses. However, they can also be a target for cybercriminals. This section highlights important precautions individuals and businesses should take to ensure the security of their payment gateway transactions.

Safeguard Card Information and Monitor Transactions:

- Protect Card Information: When making online payments, ensure that you do not store your card details on websites or apps unless they are secure and trusted platforms. Always enter card information for each transaction when possible.

- Monitor Transactions: Regularly review your bank or credit card statements to check for any unauthorized or suspicious transactions. Promptly report any discrepancies to your bank.

- Avoid Sharing Card Details or OTPs: Never share your card details or One-Time Passwords (OTPs) with anyone, especially over the phone or through email. Legitimate organizations will never ask for this information in such a manner.

- Don’t Delegate Banking Tasks: Avoid delegating online banking tasks to others, such as sharing your login credentials or card details with third parties, even if they claim to be assisting you.

- Verify Payment Gateway Information: Before making a payment on a website or app, verify that the payment gateway is legitimate and secure. Ensure the website URL starts with ‘HTTPS‘ and that it displays the correct logos and branding of the payment gateway provider.

According to FDIC Scammers often create fake websites that are similar to the sites of popular retailers, tricking consumers into providing payment information. It’s important to ensure that the website is secure before making any payment

By following these precautions, individuals and businesses can enhance the security of their payment gateway transactions and reduce the risk of falling victim to fraud or unauthorized charges. Protecting sensitive financial information is paramount in maintaining a secure online payment experience.

Methods Of Fraudulent Activities

Understanding the methods employed by fraudsters is essential to recognize and defend against cyber threats effectively.

Phishing:

- Overview: Phishing is a technique where cybercriminals masquerade as trustworthy entities to trick individuals into revealing sensitive information, such as login credentials, credit card numbers, or personal details.

- Awareness and Diligence: Recognizing phishing attempts involves staying vigilant for suspicious emails, messages, or websites. Phishing emails often contain links to fake login pages or ask for sensitive information.

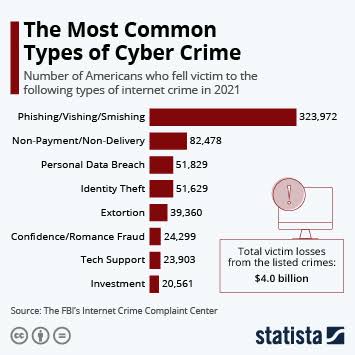

According to the FBI’s Internet Crime Report, phishing was the most common type of cybercrime in 2020, with over 241,000 reported cases, resulting in losses of over $54 million.

Fake UPI Payments & Scams

In recent years, the rise of digital payment platforms has also given rise to scams targeting users of these services. This section specifically explores the phenomenon of fake UPI payments and the scams associated with them.

Introduction to Fake UPI Payments:

- Fake UPI payments refer to deceptive schemes aimed at tricking users into believing they have received or made legitimate transactions. These scams often involve the creation of counterfeit payment proof.

- Common forms of fake UPI payments include fake payment screenshots, counterfeit UPI QR codes, and impersonation scams where fraudsters pose as genuine buyers or sellers.

According to a report by Business Today, protecting yourself from fake UPI payments requires vigilance and awareness of standard scam indicators. The report emphasizes the need to verify sources, adopt secure practices, and monitor transaction details for suspicious activity.

Methods of Generating Fake Cash App Screenshots

- Receipt Generator Apps/Software: Specifically designed apps for creating counterfeit receipts and screenshots.

- Photoshop and Editing Tools: Utilizing editing software to modify screenshots and alter payment amounts.

According to a report by Juniper Research, the global cost of online payment fraud is expected to reach $206 billion by 2025, with North America being one of the regions most affected by online payment fraud, with losses expected to reach $50 billion by 2025

- Fake Cash App Screenshot Generator

- This tool allows users to generate fake Cash App balances and receipts to deceive others. Scammers use this tool to create fake Cash App screenshots to trick people into sending them money or personal information.

- Prank Payment

- A website that lets users create fake Google Pay screenshots. It requires users to download the app and provide the necessary information to generate the fake payment screenshot.

- Receipt Prank APK

- This tool is considered one of the best fake Cash App screenshot generator tools. It has been removed from the web, but a few sources still have the Receipt Prank APK available for download.

- FakeMoney – FakePay&Note Guide

- Description: An app available on Google Play that allows users to share fake money transfer screenshots with friends and family. It is designed for entertainment and pranking purposes.

PayPal Fake Payment Scams:

- PayPal, a prominent mobile payment platform, has witnessed an increase in fake payment scams. Fraudsters exploit vulnerabilities or manipulate the app’s interface to create the illusion of successful transactions.

According to a report by CNBC, a survey found that 9% of users who use mobile payment apps at least once a week reported being scammed. This indicates the prevalence of scams on mobile payment platforms

- These scams can lead to financial losses for both individuals and businesses, undermining trust in the platform.

According to Linkedin.com Scammers use these fake screenshots to trick people into sending them money or personal information. These screenshots are often created to look like real Cash App transactions, but they are actually just photoshopped images

Identifying Fake UPI Payments:

Aura.com provides information on how to spot fake QR code scams, with examples of how these scams can lead to phishing websites that steal financial information

- Watch out for unsolicited payment requests, especially from unknown sources. Verify the legitimacy of the requestor and the transaction details before accepting a UPI payment.

- Be cautious of payment amounts that seem unusually high or low and scrutinize the transaction for any grammatical errors or inconsistencies in branding.

- Avoid clicking on links or opening attachments in unsolicited payment notifications, as they may lead to phishing websites or malware.

Protective Measures Against Fake UPI Payments:

- Never share your UPI PIN or OTP with anyone, as legitimate transactions do not require this information to be disclosed.

- Verify the identity of the sender before accepting a UPI payment, especially if it’s from an unfamiliar source.

- Keep your UPI apps updated with the latest security patches, use strong and unique passwords, and avoid conducting transactions over public Wi-Fi networks.

- If you encounter suspicious activity or believe you have received a fake UPI payment, report it to your bank or the UPI service provider immediately.

Being aware of the risks associated with fake UPI payments and understanding how these scams work is essential for individuals and businesses to protect themselves from financial losses and maintain trust in digital payment platforms.

Conclusion

In conclusion, safeguarding oneself and one’s finances against fake online payments and transactions is paramount in today’s digital age. This report has provided valuable insights and practical guidance on how to stay safe in the digital payment landscape.

By adhering to the methods mentioned above, comprehending the risks associated with UPI and digital wallet fraud, securing payment gateways, and being aware of common fraudulent methods, individuals and businesses can significantly diminish their vulnerability to cyber threats and financial fraud.

Furthermore, being vigilant and proactive in detecting and preventing payment fraud not only protects personal and financial information but also contributes to a safer digital payment ecosystem for everyone.